Asacube Android banking Botnet 2024

The Asacube banking botnet has emerged as one of the most sophisticated mobile threats in 2024, specifically targeting financial applications on Android devices. This advanced malware demonstrates the evolving capabilities of mobile banking Trojans, combining traditional botnet functionality with financial fraud techniques. Security researchers study this threat to develop better protections for mobile banking ecosystems.

Download Link 1

Download Link 2

Download Link 3

Download Link 4

What is Asacube?

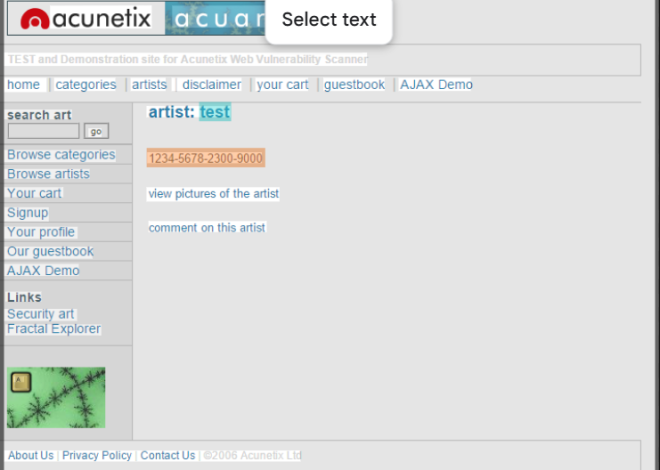

Asacube is a next-generation Android banking botnet that combines remote access capabilities with financial fraud modules. Unlike traditional banking Trojans, it operates as a full-fledged botnet with centralized command-and-control (C2) infrastructure, allowing attackers to execute coordinated attacks against multiple financial institutions simultaneously. Ethical researchers analyze its techniques to improve mobile security defenses.

Detailed Features of Asacube Android Banking Botnet (2024)

| Feature Category | Capabilities | Technical Implementation | Evasion Level |

|---|---|---|---|

| Botnet Architecture | C2 communication | Uses WebSockets with AES encryption | High (Mimics legit traffic) |

| Injection Framework | Overlay attacks | Dynamic generation of fake banking screens | Extreme (Per-app customization) |

| Accessibility Abuse | Full device control | Uses Android accessibility services for persistence | High (System-level access) |

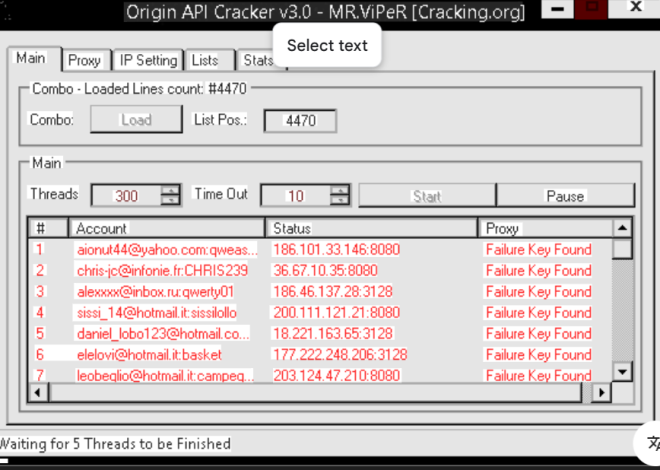

| Financial Modules | Transaction hijacking | Real-time interception of 2FA codes/SMS | Extreme (Bypasses most bank security) |

| Stealth Mechanisms | Anti-emulation checks | Detects sandbox/virtual environments | High (Delays malicious payloads) |

| Update System | Modular plugins | Downloads new attack modules from C2 | Extreme (Polymorphic updates) |

| Lateral Movement | Contact infection | Spreads via SMS with malicious links | Moderate (Social engineering) |

Why Hackers Use Asacube Android banking Botnet 2024?

- Mobile Threat Intelligence – Understanding next-gen banking Trojan techniques

- Financial Security Research – Developing better app shielding technologies

- Red Team Exercises – Testing mobile banking security for financial institutions

- Malware Analysis – Creating detection signatures for security vendors