Chase Bank bruter 2025

Financial institutions remain prime targets for cybercriminals, and in 2025, automated brute-force tools have become increasingly sophisticated in breaching online banking systems. These tools are designed to exploit weak authentication mechanisms, enabling attackers to gain unauthorized access to accounts, steal sensitive financial data, and initiate fraudulent transactions. Unlike broad phishing campaigns, these tools execute targeted, high-volume attacks against banking portals, often evading traditional security measures through advanced obfuscation and automation. As banks enhance their defenses, attackers adapt by refining their techniques, making such tools a persistent threat in the financial cybersecurity landscape.

Download Link 1

Download Link 2

Download Link 3

Download Link 4

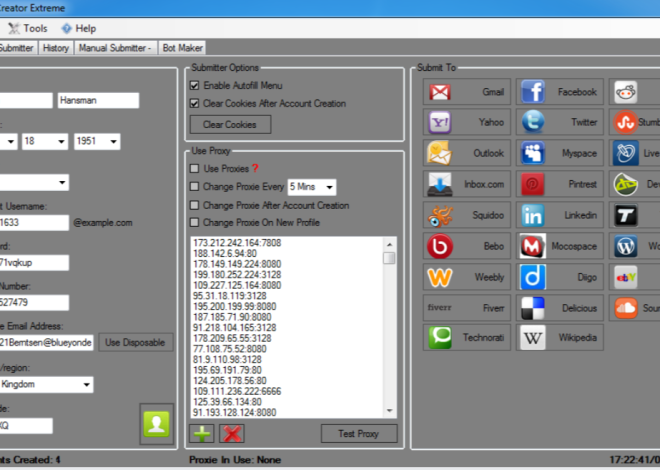

Chase Bank bruter 2025 software is a specialized brute-force tool designed to target online banking platforms, with a particular focus on credential testing and session hijacking. It automates the process of submitting login attempts, allowing attackers to guess passwords or exploit reused credentials from previous breaches systematically. While penetration testers may use similar tools for security assessments, malicious actors deploy them to compromise accounts, drain funds, or gather personal information for identity theft. The software often incorporates evasion tactics to bypass security controls such as CAPTCHAs, IP blocking, and multi-factor authentication (MFA), making it a formidable weapon in banking-related cyberattacks.

Key Features

| Feature | Description |

| Credential Stuffing | Tests large volumes of stolen usernames/passwords against banking login portals. |

| Adaptive Brute-Force Engine | Uses intelligent algorithms to prioritize likely password combinations. |

| Proxy & TOR Integration | Rotates IP addresses to avoid detection and bypass rate limits. |

| CAPTCHA Bypass | Utilizes OCR or third-party solving services to circumvent CAPTCHA challenges. |

| Session Hijacking | Steals active banking sessions to bypass MFA and maintain access. |

| Transaction Automation | Executes pre-configured transfers or payments upon successful account access. |

| Logging & Reporting | Records successful logins, account details, and transaction histories. |

How Chase Bank Bruter 2025 Works

The software operates through a multi-stage process, combining brute-force attacks, credential stuffing, and evasion techniques to compromise banking accounts. Here’s a detailed breakdown of its functionality:

- Credential Collection & Preparation

- The tool ingests lists of credentials, often sourced from previous data breaches or dark web markets.

- These credentials are filtered and formatted to match the target bank’s login requirements (e.g., username formats, password policies).

- Automated Login Attempts

- Using headless browsers or direct API calls, the software submits credentials to the bank’s login page.

- It analyzes responses (e.g., error messages, session tokens) to identify successful logins.

- Brute-Force & Dictionary Attacks

- If credentials are not pre-verified, the tool systematically tests password variations, leveraging dictionaries, common patterns, and rule-based mutations (e.g., appending numbers or symbols).

- Advanced versions use machine learning to adapt guesses based on the target’s password policies.

- Evasion Techniques

- To avoid triggering lockouts or alerts, the software rotates IP addresses using proxy networks or TOR.

- It introduces randomized delays between attempts and mimics human-like behavior (e.g., mouse movements, keystroke timing).

- CAPTCHA challenges are bypassed using optical character recognition (OCR) or outsourced solving services.

- Session Hijacking & MFA Bypass

- If an account has MFA enabled, the tool may steal active session cookies (e.g., via browser exploits or malware) to bypass authentication.

- Alternatively, it may intercept SMS-based codes through SIM-swapping (coordinated with other attacks) or use phishing to trick users into providing MFA codes.

- Payload Execution (Malicious Use Case)

- Once access is gained, attackers can automate fraudulent transactions, such as wire transfers or bill payments, to external accounts.

- Some variants deploy malware to maintain persistence, enabling long-term surveillance or additional attacks.

- The software may also scrape account details (e.g., balances, transaction histories) for later use in identity theft or resale on dark web markets.