BRATA RAT 2025

BRATA RAT 2025 represents a dangerous evolution in financial malware, combining sophisticated remote access capabilities with advanced banking fraud techniques. This latest iteration of the notorious Trojan has been observed in targeted attacks against financial institutions and their customers across multiple continents. Security analysts have documented its improved evasion techniques and modular architecture, allowing attackers to customize payloads for specific banking applications and financial platforms. The 2025 version demonstrates concerning advancements in persistence mechanisms and anti-analysis capabilities, making it particularly effective at bypassing modern security measures while maintaining long-term access to compromised devices.

Download Link 1

Download Link 2

Download Link 3

Download Link 4

What is the BRATA RAT 2025

This banking trojan operates as a multi-stage threat designed specifically for financial fraud and data theft. The software is typically distributed through:

- SMS phishing (smishing) campaigns impersonating banks.

- Fake banking applications in third-party app stores.

- Compromised websites posing as financial services.

- Malicious email attachments targeting finance departments.

Once installed, it enables attackers to:

- Capture online banking credentials through overlay attacks.

- Bypass multi-factor authentication (MFA) mechanisms.

- Initiate fraudulent transactions through remote control.

- Monitor victim activity through screen recording.

- Collect sensitive financial documents.

Key Features

| Feature | Description |

| Dynamic Overlay Attacks | Displays fake login screens for targeted banking apps |

| Session Hijacking | Steals authentication cookies and tokens |

| Remote Control | Provides attackers with real-time device access |

| MFA Bypass | Intercepts SMS codes and authentication prompts |

| Screen Recording | Captures user activity for later analysis |

| File Exfiltration | Steals financial documents and sensitive files |

| Self-Destruct | Removes traces of infection after completing objectives |

How BRATA RAT 2025 works

1. Delivery and Initial Infection

The malware employs multiple distribution vectors:

- Social engineering tactics to trick users into installing malicious APKs.

- Exploitation of accessibility services to gain persistent permissions.

- Dropper applications that download the full payload post-installation.

Upon execution, it:

- Requests extensive permissions (accessibility, SMS, overlay).

- Disables Google Play Protect and other security features.

- Establishes communication with C2 servers.

- Downloads configuration files for targeted banks.

2. Banking Fraud Techniques

The Trojan implements sophisticated financial theft methods:

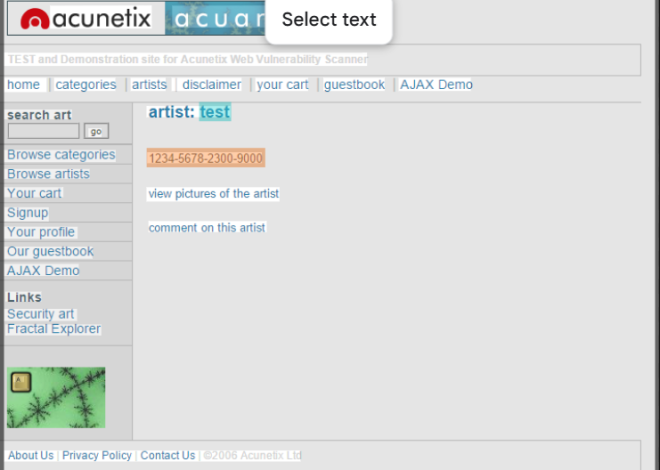

Overlay Attacks:

- Detects when specific banking apps are opened.

- Displays identical-looking fake login screens.

- Captures entered credentials in real-time.

Session Hijacking:

- Steals authentication cookies and tokens.

- Replays sessions to bypass login procedures.

- Maintains active sessions for fraudulent transactions.

MFA Bypass:

- Intercepts SMS verification codes.

- Captures push notification approvals.

- Uses accessibility services to auto-confirm transactions.

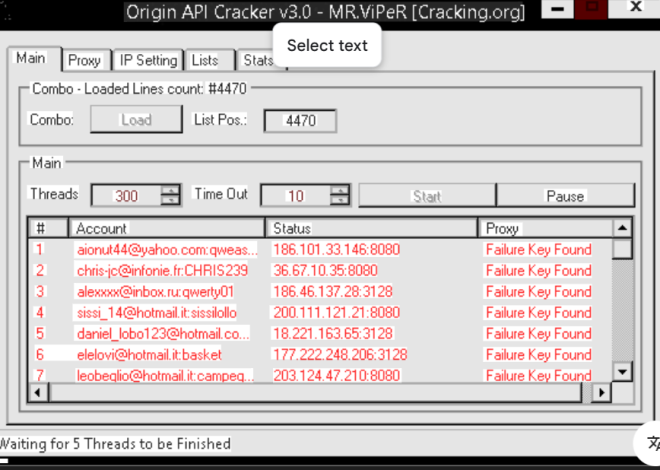

3. Data Exfiltration and C2 Communication

Stolen data is transmitted via:

- Encrypted HTTPS connections to C2 servers.

- Telegram bots for real-time data access.

- Temporary cloud storage for large document transfers.

The malware uses:

- Domain generation algorithms (DGA) for resilient C2.

- Fast-flux DNS to evade takedowns.

- Encrypted configuration files.

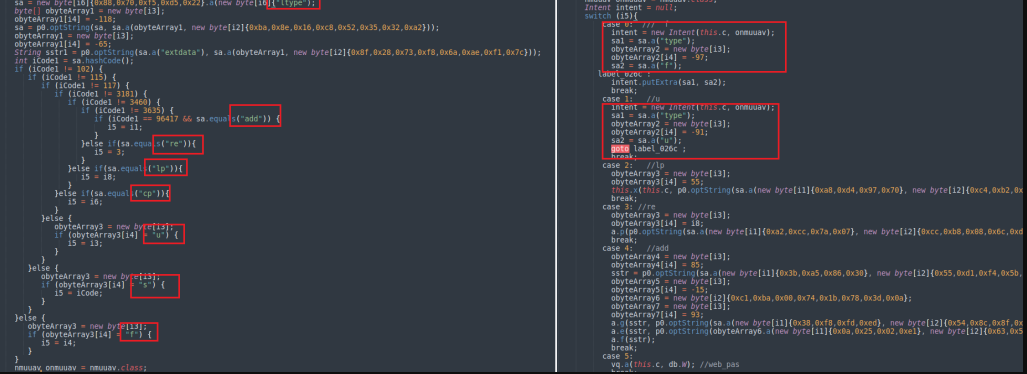

4. Persistence and Evasion

Advanced techniques include:

- Multiple persistence mechanisms (foreground services, broadcast receivers).

- Code obfuscation and anti-debugging measures.

- Sandbox detection to prevent analysis.

- Dynamic payload loading to reduce the initial footprint.

- Self-destruct sequence when detected